Keywords Studios’ (LSE: KWS) share price has taken a huge hit recently. At the end of April, the stock was trading at 2,700p. Today however, it’s near 1,750p.

So what on earth has happened to the video game services company? And is this an excellent buying opportunity?

The threat of AI

It seems to me that the massive drop in the share price is related to the threat that generative artificial intelligence (AI) poses to the company.

This year has been a game-changer for generative AI because apps like Open AI’s ChatGPT and Google’s Bard have shown us all what it’s capable of. Put simply, it’s both astonishing and a little scary.

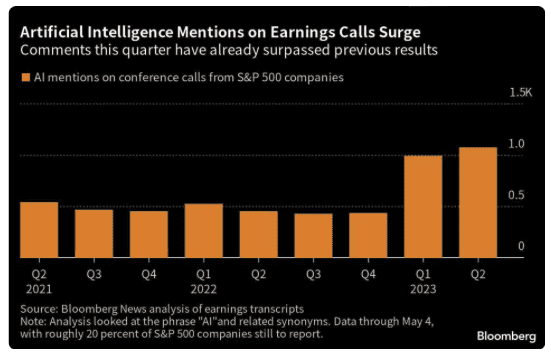

As a result, nearly every company across the world is currently looking into how it can use AI to automate processes and reduce costs. In a Q1 earnings calls, for example, AI was one of the most dominant themes.

Source: Bloomberg

Now this could have significant implications for a company like Keywords Studios. That’s because many of the services it offers, such as video game artwork, language translation, localisation, and marketing (a lot of which are done by humans), could potentially be done in-house by game developers in the future using generative AI technology.

This means that the company could see its revenues dry up.

Human jobs at risk

It’s worth noting that Keywords Studios isn’t the only stock that has taken a hit recently as a result of artificial intelligence. Just look at the share price of freelance work platform Upwork. It has also tanked in the last few months. Clearly, a lot of investors believe that many human jobs will be replaced by AI in the future.

What now?

As for my view on Keywords shares today, I have to admit I’m torn between being bullish and bearish.

My gut feeling here is that the fears around AI are overblown and that the share price has fallen too far.

Currently, the stock’s forward-looking price-to-earnings (P/E) ratio is just 17. That seems low to me.

It’s worth noting that the shares have experienced major declines in the past and then rebounded, providing strong returns for those who had the courage to buy the dip.

On the other hand, AI technology is moving at an exponential pace right now, and it could have a very disruptive impact on a lot of industries, including video gaming, in the years ahead. So there is plenty of uncertainty here.

I will point out that Keywords has said it’s embracing generative AI. It has been investing in the space for years (well before ChatGPT was launched) and management believes it will create “incredible opportunities” to help game publishers. However, it’s hard to know how this will play out.

Another thing that’s worth mentioning is that there are a few short sellers sniffing around the stock. This is sometimes an indicator that there is trouble ahead.

Weighing everything up, I’m going to leave the shares on my watchlist for now. I do think they look interesting at the moment.

However, given the high level of uncertainty, I think there are safer stocks to buy today.